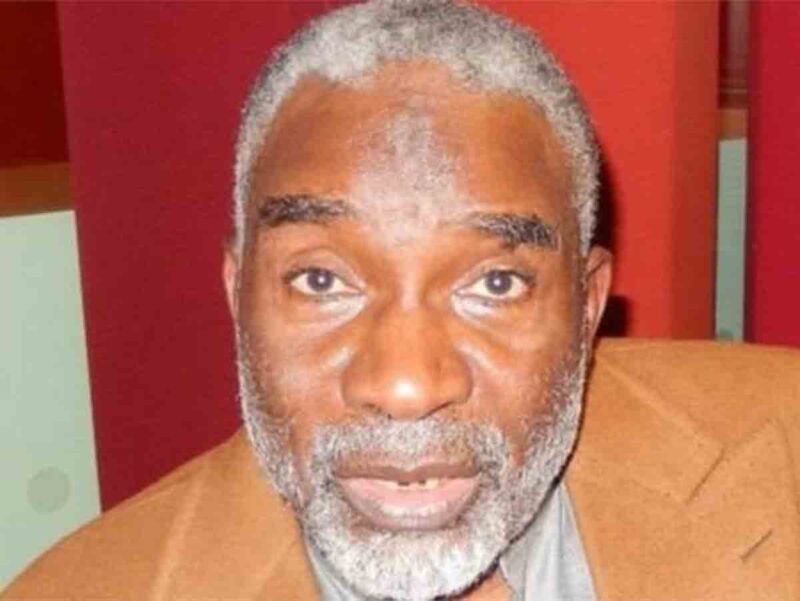

Chinedu Roland Okoronkwo trial continues in Enugu as EFCC exposes N91.55m Ponzi scheme through unlicensed microfinance bank

Chinedu Roland Okoronkwo trial resumed on Friday, September 26, 2025, at the Federal High Court, Independence Layout, Enugu, with a witness detailing how the alleged Ponzi scheme operator diverted N91,550,000 from victims using an unlicensed microfinance bank.

Also read: Olusanya Adeniran faces N50B forex scam allegations

Okoronkwo and his company, Reliance Microfinance Cooperative Society Limited, face 36-count charges from the EFCC, including forgery, obtaining money by false pretence, and operating a banking business without a licence.

During proceedings, EFCC’s Ninth Prosecution Witness, Detective Superintendent Abubakar A. Abubakar, explained that Okoronkwo recruited victims through his church.

He analysed bank statements, revealing that Reliance’s Guaranty Trust Bank account received N69,850,000, while a United Bank for Africa account received N21,700,000 from investors.

Abubakar also confirmed that the microfinance cooperative was neither licensed by the Central Bank of Nigeria nor insured by the Nigerian Deposit Insurance Corporation, tendering a letter from NDIC as Exhibit 44.

The witness further testified that Okoronkwo is the CEO and sole signatory of Reliance’s accounts, establishing his direct control over the alleged fraudulent operations.

The trial was adjourned to October 14 and 17, 2025, for continuation. Among the charges is the allegation that on October 9, 2018, Okoronkwo and Reliance obtained N15 million from an investor under the false pretense that the cooperative was a licensed microfinance bank, contrary to Section 1 of the Advance Fee Fraud and Other Fraud Related Offences Act 2006.

Also read: Man jailed over $42,000, N37 million crypto money laundering case

The case highlights ongoing concerns over unlicensed financial operators in Nigeria and the EFCC’s continued efforts to safeguard investors against fraudulent schemes.