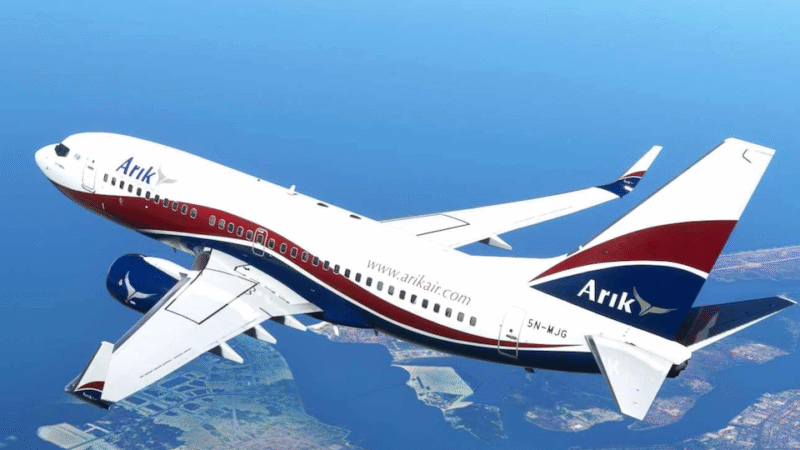

A former Union Bank executive, Austine Obigwe, testified in the N76bn AMCON fraud trial, revealing he wrote off a $2.3M debt owed by Arik Air and confirming the airline met loan obligations during his tenure at the bank

[dropcap]M[/dropcap]r. Austine Obigwe, a former Group Executive Director of Union Bank Plc, testified on Wednesday, May 28, 2025, before a Lagos State Special Offences Court in Ikeja, revealing that he wrote off a $2.3 million debt owed to his private company, Staal, by the troubled airline, Arik Air.

Also read: Nigerian govt grounds Arik Air over $2.5m debt

Obigwe, who appeared as the second prosecution witness in the ongoing trial of former Managing Director of the Asset Management Corporation of Nigeria (AMCON), Mr. Ahmed Kuru, and four others, explained that he made the decision to forgive the debt in 2011 after Arik Air began experiencing “operational turbulence.”

According to Obigwe, the debt arose two years after his exit from Union Bank in 2009. He described the write-off as a “commercial decision,” stating during cross-examination: “I am not interested in collecting it. I wrote it off when I discovered that Arik Air started having challenges.”

Led in evidence by Dr. Wahab Shittu (SAN), Obigwe further disclosed that after leaving Union Bank, he became a consultant to Arik Air and other organizations.

He also admitted having a personal relationship with Arik Air founder, Sir Johnson Arumemi-Ikhide, though he currently has no formal business ties with the airline.

Kuru and his co-defendants—former Arik Air Receiver Manager, Mr. Kamilu Omokide; Arik CEO, Capt. Roy Ilegbodu; Union Bank of Nigeria Plc; and Super Bravo Ltd—are being prosecuted by the Economic and Financial Crimes Commission (EFCC).

They face a six-count charge bordering on conspiracy, stealing, and abuse of office, involving over N76 billion and $31.5 million.

All defendants have pleaded not guilty, and Justice Mojisola Dada has granted them bail in the sum of N20 million each with one surety in like sum.

Obigwe also offered insight into Arik Air’s financial relations with Union Bank during his tenure. He stated that while he was in office, Arik Air consistently met its loan obligations, and the facilities extended to it were performing.

“Until I left the bank in 2009, all facilities extended to Arik were performing. There was no default,” he told the court.

I am not interested in collecting it. I wrote it off when I discovered that Arik Air started having challenges.

He further disclosed that Union Bank provided guarantees to Arik Air for the purchase of five aircraft: three Boeing 737-800 for domestic use and two wide-body Airbus A340-500 aircraft used on international routes to New York and London.

These transactions, he noted, were backed by export credit agencies including Coface of Germany, ECGD of the UK, and the US EXIM Bank.

“The three of them are also shareholders. The two Boeing aircraft were financed by the Export Credit Agencies. Union Bank did not commit any money for the guarantee of the 85 per cent,” Obigwe explained.

He added: “We also had a second transaction for two wide-body aircraft — A340-500 — with Coface of Germany and ECGD of UK. Union Bank stood in as guarantor, but there was no direct financial commitment from the bank.”

During cross-examination by defence counsel—including Mr. Olasupo Shasore, SAN; Mr. Olalekan Ojo, SAN; and Mr. Tayo Oyedepo, SAN—Obigwe stated that he participated in a 2009 inspection of 26 Arik aircraft, which were certified airworthy by Lufthansa.

He affirmed that he had no reason to doubt Lufthansa’s evaluation, noting the inspection aimed to confirm the operational strength of the airline’s fleet.

When questioned about other financial institutions raising concerns about Arik’s loan repayment, he said no such issues were brought to his attention during his tenure.

Responding to questions about a letter dated April 23, 2009, allegedly written by AMCON to Union Bank regarding a N46.11 billion debt, Obigwe stated he was unaware of it and that the correspondence never reached him before his departure from the bank.

Speaking on remedies available to financial institutions when a borrower defaults, the former bank executive noted that lenders may assign or transfer the debt to another bank, or enforce the security backing the facility.

He affirmed that banks are legally empowered to dispose of collateral in the event of a borrower’s default.

Also read: ‘Gross act of indiscipline’ Arik Air lays off pilots over strike action

“I can only speak for the period I was there. When I was in Union Bank, Arik Air was one of the best companies,” Obigwe added when asked to appraise Arik’s character and corporate management.

Justice Dada adjourned further hearing to June 4, 2025, for continuation of trial.