====

In the heat of the global financial crisis, a regional bank with negative retained earnings in excess of N45billion appointed Segun Oloketuyi as Managing Director. Burdened with the bad fortunes of the bank and a global financial meltdown, Segun’s failure would have been quite excusable. But amazingly, his team led the bank to resurgence and national competitiveness within six years.

For over 70 years (Wema is proudly Nigeria’s longest surviving indigenous bank), Wema Bank was hardly known, strapped down by orthodox practices and inefficiencies, its fortunes however turned around when Oloketuyi’s team took on rigorous rebranding, branch remodeling, and fast digital transformation across its operations. Of all the strategies deployed, the pursuit of technology adoption soon prove to be the ace in the emergence of the new Wema.

Then enters Alat by Wema, Nigeria’s first fully digital bank and the bank’s springboard into exponential growth and industry leadership. ALAT was launched on May 2, 2017 and during its first year, it acquired more than 250,000 customers responsible for well over NGN 1.6bn ($4.48m) in general deposits. In 2018, the bank closed in the NGN 1bn ($2.78m) mark in terms of deposits into savings accounts.

It’s the digital age and majority of the world’s youthful population have grown in a highly disruptive world, hence they are early adopters of technology and lovers of change to status quo. Nigeria being a nation where 7 in every 10 persons are youths is definitely more likely to push on this trend. Therefore, it was a master stroke by Wema to run ahead of the time with this flagship product.

In fact, the growth of fintech in Nigeria is traceable to the development of digital banking in the country, spear-headed by the establishment of ALAT by Wema, in 2017.

ALAT by Wema came at a period when many Nigerians felt it was almost impossible to open and operate a fully-functioning bank from a digital device without stepping into a banking hall. As of 2017, some forms of banking still required physical presence to complete, including KYC, account update, address change, etc. ALAT provided a banking solution that sped-up Nigeria’s digital banking growth.

The provision of seamless, paperless banking by ALAT and its efficiency witnessed immediate acceptance from Nigerians. Within a year of its launch, 250,000 accounts were opened with N1.6 billion in deposit. The bank has continued to yield growth, but what is of significance to the Nigerian fintech and digital banking space, is the trailblazing move that has changed the financial ecosystem.

The spread of the COVID-19 pandemic in early 2020 has further increased digital banking globally. According to Reuters, the pandemic increased the demand for digital banking in Nigeria as more and more people opt for online banking because of the lockdown and restriction on physical banking. This trend has continued into 2021 and is expected to carry on. The foresight and revolutionary presence of ALAT positioned it as an already tried and trusted system rather than a quick-fix solution coming onto the stage because of the pandemic.

Wema smartly productised banking, extricated it from its poor reputation and sailed it on the wind of change. Brilliant! The growth ever since has been enormous. The first quarter report of this year for the industry saw Wema leading as the Most Profitable Bank in Nigeria with a PAT growth of +119%! Commendable.

Freelanews Bureau of Investigation, FBI, has established in its earlier analysis the price of sporadic growth. Wema, its poster boy of digital transformation, and stupendous growth have come at a cost to the public. There are truth-wading allegations of fraud, data theft, breach of trust, money laundering, and sharp practices in the operations of the bank. For the sake of brevity we will x-ray a few below:

Unauthorised Account Opening/Customer Data pilferage

There have been several allegations from various people about unauthorised account opening by Wema bank on its ALAT platform. Though the bank have continued to deny these allegations, the most recent indictment comes with strong evidence that spots its complicity or maybe, compromise.

Peter Adebayo, a Nigerian researcher living abroad, recently accused Wema Bank of fraudulently opening an ALAT Bank account in his name without his authorisation.

Peter narrated that his mother called him on May 3, 2022 to ask if he had opened a new account with the bank, but he thought it was nothing to be worried about.

He also thought the message the bank sent was a mistake until he tried sending money to the said account number.

“While trying to confirm whether the account was real or not, it brought out my name,” he said.

“I immediately sent Wema Bank an email that I had never opened an account with the bank and had authorised no one to open a bank account in my name.

“Wema Bank later sent me an auto response acknowledging receipt of my mail. Fast forward to today, I checked again and the account still exists. I got mad, so I reached out to them on WhatsApp.”

He stated that he was stunned on hearing what the bank told him, because that signaled to him that someone might have used his details to either receive a ransom or launder money.

“I am concerned about how my information has been used by Wema Bank and I need a detailed explanation about the account, including all the transactions that have been performed on it,” he said.

After reaching out to Wema Bank on WhatsApp, the bank told Adebayo ‘that someone who had his information opened the account on his behalf’.

He stated that he was stunned on hearing what the bank told him, because that signaled to him that someone might have used his details to either receive a ransom or launder money.

“I am concerned about how my information has been used by Wema Bank and I need a detailed explanation about the account, including all the transactions that have been performed on it,” he said.

“Now, Wema Bank wants to close the account since I have been asking them questions. I already have an existing account with Wema Bank, which I opened in October. I recently traveled out of Nigeria and I cannot go to the bank to do certain things. I did not sign up for any account.”

The proliferation of this nefarious activities have elicited reaction from the government. The Federal Government through the Federal Competition and Consumer Protection Commission (FCCPC) has queried Wema Bank Plc over illegal banking practices in the country.

This comes after allegations that the bank and its agents have been opening unauthorized accounts for customers with information sourced from their Bank Verification Number (BVN) details.

The Nigeria Data Protection Bureau (NDPB) has also announced the commencement of an investigation into Wema Bank’s activities following the alleged data breach and illegal opening of accounts by the bank.

Babatunde Bamigboye, Head of Legal, Enforcement, and Regulations Lead at the NDPB announced the development in a statement on Tuesday.

The statement said, “Nigeria Data Protection Bureau (the Bureau) has commenced investigations into reports of a breach of data privacy involving two major data controllers in Nigeria, namely, Wema Bank PLC and KC Gaming Networks (Bet9ja). This is in line with Section 37 of the 1999 Constitution and the provisions of Nigeria Data Protection Regulation (NDPR) 2019 – particularly Articles 2.1(2)-(3), 2.6, and Article 4 of the NDPR.”

The above allegation sort of point to one question; is Wells Fargo Wema Bank’s playbook?

Mystery around N1.7billion ‘Erroneous’ loan disbursement to Shibahlwells

News broke in February, 2022 of the arraignment of one Isaac Adewole, a pastor of the Redeemed Christian Church of God and Kingsley Ananwede, a staff of Wema Bank on allegations of money laundering, etc. The stories that got into the media got this narrative journey:

Part One (22 February to 22nd March, 2022): report, investigation and charge to court

- Timi Popoola reports Isaac Adewole, Wema Bank to Area G on suspicion of fraudulent transactions on a loan account his property is tied to as collateral

- Case is investigated and substance is found against Wema and Shibahwells Energy, Isaac Adewole’s company. Review of bank statement account shows that five large transfers are found questionable.

- All companies that the statement named as sender of those funds were contacted and denied any such transaction originating from them

- Adewole insisted the transfers were error by Wema bank and were reversed.

- Police takes the fact that the reversals were done in smaller chunks and to different accounts as evidence to press money laundering charges

- Case was charged to court in Ogba

Details of the story

Investigating Police Officer remarked, “He used his neighbour’s house for collateral of the loan which was granted to him and promised to return it within six months. But three years after, the man approached him for his house document and that was when he told him of the fraudulent act. He said the bank paid N1.7 billion into the account using different multinational companies like Dana Airlines, Caverton helicopter and two others, one N300 million, one N270 million, one 600 million and like that, it’s only one of the transactions that they didn’t put a name there.

“Guess what they do after, they now moved that N1.7 billion from Adewole’s accounting into different bank accounts in tranches. Like the one I told you —N600 million, they immediately put it in another account in form of N150 million, 100 million, N100 million, N90 million. The pastor’s account is known as Shibawells Energy Limited. The one for Dana that they moved N160 million to, that was how they did it too, they immediately sent it to another account in smaller units as well.

“He has a partner, we called him and realised he wasn’t aware of the transaction. He was shocked, he realised the statement presented to him was forged to hide the fraudulent transaction.”

According to Adewole’s statement of account obtained by SaharaReporters, on January 28 2021, via transaction ID No: M35660, he received the sum of N424,811,000 from Caverton, N160,000,000 from Dana and N630,000,000 from Beam Energy, all with the same transaction number.

On June 18, 2021, via transaction ID No: M104031, the pastor received the sum of N300,000,000 via NIP transfer from an undisclosed account source.

Also on same June 18, 2021, via transaction ID No: M104031, Adewole received the sum of N270,000,000 from Messrs Morrifoil Oil and Gas Ltd., all totaling N1,784,811,000.

Investigating Police Officer establishes substance…

“To determine whether fraud or money laundering has occurred by these established facts, the account officer of Shibahwells in WEMA Bank PLC., one Kingsley Ananwede ‘m’ was invited and questioned. It was established that he worked in concert with other staff of WEMA Bank who are at large and the MD/CEO of Shibahwells Energy Limited to carry out the fraudulent activities on the accounts.

“This is shown by the facts that the funds deposited were not removed in that order or the sums deposited but carefully removed in different tranches as it is shown on the account statements. For his own part, Adewole refused to cooperate with the investigations but instead, did everything he could, to assist the bank in covering up. So it was decided that the case be referred to the Lagos State Ministry of Justice for Legal Advice.

Part Two: Adewole’s Reaction

In a petition to the Lagos State Attorney General and Commissioner for Justice, Adewole, who is also the Managing Director of Shibawells Energy said the N1.7 billion transfer to his loan account was made in error and was reversed immediately.

He accused Popoola, who he used his property as part of the collateral to secure the loan at the bank of planning to use the error to “embarrass one of its Executive Directors over some unresolved personal feud.”

Isaac Adewole said through his lawyers…

“To meet Timi Popoola’s demand, Shibahwells approached Wema Bank with a request to withdraw Timi Popoola’s title documents from the loan obligation and to replace same with other security to be provided by the Star Orient/Shibahwells joint venture. Some of the letters by Shibahwells to Wema Bank in this regard are attached as ANNEXURE 4. In response, Wema Bank called for a reconciliation of the loan account with a view to determining the extent of Shibahwells’ indebtedness to the bank. A consultant nominated by the bank was engaged to carry out the reconciliation of Shibahwells’ loan account and in the course of that reconciliation, the consultant discovered that the loan account had been erroneously credited and debited with some funds at different times/dates.

“The consultant brought this discovery to our client’s attention and also notified Wema Bank. In reaction, Wema Bank stated that the said bank transfers into the loan account were made in error and that the same was reversed immediately on each occasion the erroneous transfers occurred. On one occasion while our client was spending time with Timi Popoola and Lanre Bamgbose, a shareholder and director in Star Orient; the issue of erroneous funds transfer to Shibahwells loan account came up for discussion whereupon each person expressed different views as to the likely origin of the funds. Our client used this opportunity to clear the doubts by informing both Timi Popoola and Lanre Bamgbose that Wema Bank had already confirmed that the transfers were made into the loan account in error and that same were reversed immediately.

“To our client’s shock, Timi Popoola furiously stated that he was going to leverage the bank’s error to embarrass one of its Executive Directors over some unresolved personal feud. Our client immediately pleaded with Timi Popoola not to toe this path of blackmail, especially since posting funds across customers’ bank accounts was typically not part of the responsibility of a bank’s Executive Director. The conversation ended on this note.

“With a settled expectation that the doubts around the erroneous bank transfers had been resolved, our client was surprised to receive an invite from Area G Command of the Nigeria Police Force, Ogba, Lagos on 5th November 2021. Upon honouring the police invitation on 8th November 2021, our client was informed that Timi Popoola had reported a case of suspected money laundry activities perpetrated by our client and Wema Bank.”

“During the meeting with ACP Ibrahim Zungura, our client was asked questions relating to the inflows and outflows on the Shibahwells loan account with Wema Bank. In particular, ACP Ibrahim Zungura cajoled our client to cooperate with the police so that the matter would be dispensed with at the Area G Command. Our client volunteered a written statement disclosing all he knows about the erroneous inflows and outflows on the Shibahwells loan account.

Part Three: Media reports that case has been quashed

In a pattern of smart crisis communications, several news platforms published stories of how the case have been quashed by the court. The stories on Nairametrics, Guardian, ThisDay, Vanguard, Pulse.ng, Independent.ng, instablog, and other top blogs carried the same narrative.

Below is an excerpt from Instablog:

A Lagos Magistrates Court sitting at Ogba, Ikeja has struck out money laundering charges brought against Isaac Adewole, MD, Shibahwells Energy and a staff of Wema Bank Plc, Kingsley Ananwude for lack of merit.

Magistrate A.O. Layinka (Mrs.) discharged the defendants and struck out the charge following the Legal Advice from the Office of the Director of Public Prosecution (DPP), Lagos State that no prima facie case has been established against them.

It will be recalled that the defendants were arraigned in Court on February 9, 2022, in Charge No. MIK/B/6/2022–Commissioner of Police vs. Adewole Isaac & Kingsley Ananwude, for alleged stealing and money laundering involving N1.7billion.

After pleading not guilty, the Court granted the defendants bail and then adjourned the case till March 15, 2022, for trial.

On Tuesday March 15, 2022, when the case was mentioned in Court, Magistrate Layinka (Mrs.) discharged the defendants and struck out the charge for lack of Merit after relying on the Legal Advice from the Office of the DPP, Office of the Attorney General of Lagos State/Ministry of Justice.

In the Legal Advice signed by the DPP of Lagos State (a copy of which was sighted by our correspondent), the DPP after an extensive review of the duplicate case file provided by the police authority, stated that the defendants were arrested based on rumours by one Timi Popoola and nothing more.

The DPP further stated that there is insufficient evidence to predicate the offences upon which a crIminal charge was brought before the Court.

Further investigations into the case revealed that the criminal charge of alleged stealing and money laundering involving N1.7billion and the media hysteria that followed were at the instance of Timi Popoola.

It will be recalled that the same Timi Popoola in a similar fashion sometime in February 2021, used the police to settle personal scores with Mr. Ayobami Olubiyi, the Chairman of Peace Valley Zone in Magodo G.R.A Phase 2, Lagos.

Inferences

Sponsored narrative and the effort to discredit Timi Popoola

The news of the court quashing the case was rolled out with an objective in mind. For those who understand crisis communication and reputation management in PR, it is quite easy to spot the pattern of a sponsored narrative. When all media houses (traditional and new) publish a sponsored press release, it is not without a trail. In our effort to establish this, we combed through all platforms where the news was published and as it is always the case, there was one that did a poor job – Instablog.

Instablog did not only publish the release, it also did the copy that was sent to its editorial from the office of the MD of Shibahwells Energy. See below image.

You may argue that it is necessary for such communication to come out to ‘set the record straight’, but a further digging into the communications of Shibahwell Energy shows that they are not the kind of organization given to marketing communication, or maybe a deliberate strategy to stay stealth?

However you want to judge it, we can at least agree that the communication was very well sponsored, i.e., people got paid to tell the story, exactly like Adewole and Shibahwells Energy wanted.

The mysterious identity of Isaac Adewole and Shibahwells Energy

Talking about Shibahwells (or is it Shibawells) Energy, until this case got into public view, nothing was known of it. In fact, a simple Google search returns, absolutely nothing! That company is basically non-existence online. In fact, going by the email address seen on the press release, the closest link to an online source of information (hello@shibawellsenergy.com), we tried to access the url www.shibawellsenergy.com but it returned nothing. A Whois.com domain name search returned that the domain names shibawellsenergy.com and shibahwellsenegy.com are available, which means they are currently not registered or owned by anybody.

More importantly noteworthy, for this organization there is no known address, social media account, contact, etc. Simply no source of information online for a company with businesses in hundreds of million. This is either from a total disdain for PR and Marketing Communications or a deliberate decision to remain unknown, untraceable, and unfathomable, which brings us to the identity of the owner of the company, Isaac Adewole.

Who is Isaac Adewole?

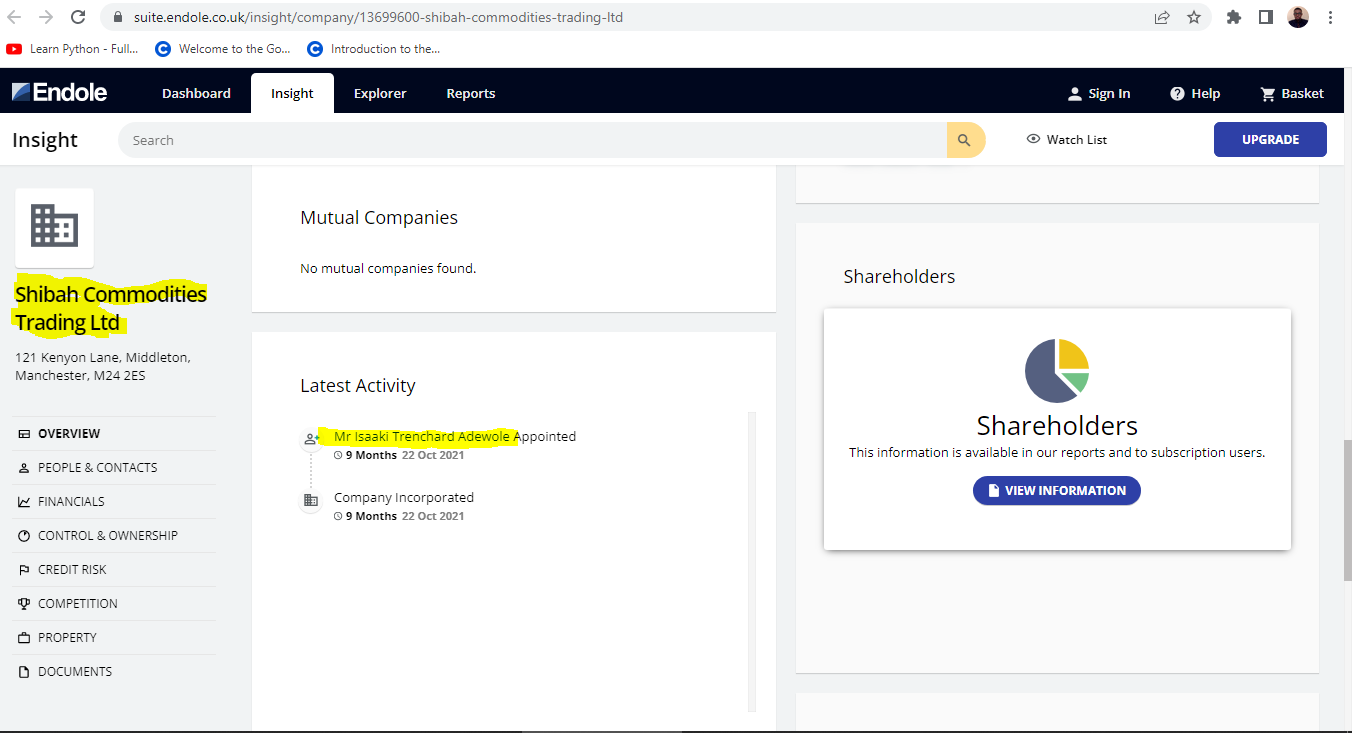

Trying to identify this individual is a job only suitable for detectives. From all the communications that surrounds this case, he went by the name Isaac Adewole. But a Freelanews research on him identifies him as Isaaki Trenchard Adewole, thanks to the British records (see image below).

Nigerian records of businesses by the name Shibah, shows the name Isaak Adewole Trenchard as a director. Star Orient, a company Isaac Adewole referred to as a partner in his reaction to the allegations, published on the website in October 2020 a new article welcoming one Isaac Trenchard Adewole to their board;

“We are pleased to welcome Mr. Trenchard Isaac Adewole and Col Richard Westley (rtd) OBE to Star Orient at such a challenging but yet exciting time…”.

By the way, Start Orient have a functioning website.

But most records outside Nigeria identify him as Isaaki Trenchard Adewole, and link him as director of companies in the UK, Netherlands, etc.

It may be dismissed that Adewole’s varying identity could be the result of ‘errors’ by other people, well that is the similar alibi for the suspicious transactions from Wema. It is quite strange that a business man of that class has no identity online, not even a photograph, beyond mention in the case in question.

Most of the bodies of knowledge that study identity fraud always flag when an individual consistently use different names in different locations and/or communications. In fact, it has been established that false identities are often used by organized crime to access goods and services or to participate in money laundering.

Silence on the materiality of probable fraud, money laundering on Wema

We may not be in a position to review or argue the Legal Advice of the Director of Public Prosecution, but would like to point out that on the said matter (alleged) the materiality of the suspicious funds transfer is material enough to place Wema Bank on stringent investigation. Some points to ponder upon are:

- It is very strange that a bank would have erroneously credited large sums of money to one lone account on five occasions.

- It is too much coincidence that the names of the transfers are all suitable customers of Star Orient, a partner of Shibahwells on the loan account. All companies denied having a record or an idea about the transactions

⦁ It is very much suspicious that the said reversals were smaller transfers to several other accounts and not wholesome reversal against the balance of Wema bank HQ

The above-stated activities are risk indicators of money laundering. There are some well-known elements that could indicate vulnerabilities to laundering. In 2021, the Financial Action Task Force (FATF) listed a list of trade-based money laundering risk indicators. One of such is Account and Transaction Risk Indicators.

Risk indicators for money laundering may include trading entities that conduct a high volume of transactions albeit in line with their stated business objectives. It may also include trading entities that receive large money deposits that are immediately transferred to other accounts without apparent justification, and payments made for imports by parties other than the account holder. The originating party should be subjected to a background test. Multiple cash deposits in quantities that fall just shy of the reporting thresholds are also risk indicators.

Some question begging for answers

- Who is Isaac Adewole?

- Is the facts of the allegations not an Account and Transaction Risk Indicator in Anti-Money Laundering and Compliance Process?

- Permit that such huge transactions were done in error, what does this tell about Wema Bank internal control system?

- How is it possible to make such ‘error’ on five occasions, spoofing with the names of multinationals in similar industries (perfect customer profile of Shibahwells Energy/Star Orient)?

- Who is covering who, the bank, the directors, or some highly powerful vested interests?

On to the next one; Zenith Bank.

Ojelabi, the publisher of Freelanews, is an award winning and professionally trained mass communicator, who writes ruthlessly about pop culture, religion, politics and entertainment.