First HoldCo loan write-off of ₦748bn slashes profit by 92% as Chairman Femi Otedola defends the move as a long-term clean-up aligned with CBN reforms

First HoldCo Plc’s profit fell by 92 percent after the parent company of First Bank of Nigeria wrote off ₦748 billion in non-performing loans in a single move.

Also read: Otedola defends painful N748bn loan cleanup at First HoldCo

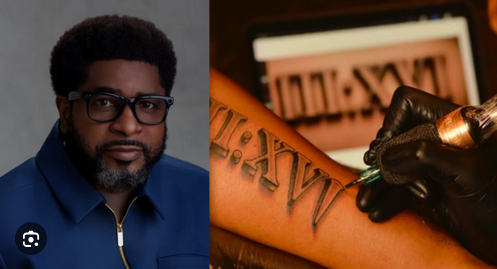

Chairman of First HoldCo Plc, Femi Otedola, disclosed this in a series of posts on his X handle on Saturday while defending the decision as a necessary long-term corrective step.

Otedola said the group opted to “clean house properly” rather than carry forward loans that had already turned bad on its books.

“That is why profit looks like it crashed by 92%. Painful headline, but it is a serious long-term move,” he wrote.

He explained that the decision aligns with the Central Bank of Nigeria’s stance urging banks to stop deferring the recognition of problem assets.

“Because the @cenbank is pushing banks to stop kicking problems down the road.

So First HoldCo basically closed the chapter on messy loans from past years, which sends a clear message that borrowing has consequences and it helps rebuild trust,” Otedola stated.

Addressing concerns that the write-off could weaken the group’s financial position, Otedola maintained that the core business remains strong.

According to him, First HoldCo recorded ₦2.96 trillion in interest income and ₦1.91 trillion in net interest income, providing sufficient strength to absorb the one-time hit.

“The key point is this: our business itself is still strong. Now at FirstBank and beyond we go into 2026 lighter, cleaner and better prepared for the recapitalisation era and serious growth,” he added.

He said the move would position the group for stability and investor confidence as the banking sector prepares for a new phase of recapitalisation and regulatory scrutiny.

Also read: First HoldCo board appointments strengthen governance

Analysts say large-scale write-offs, though painful in the short term, can improve transparency and restore confidence in financial reporting when supported by strong underlying earnings.