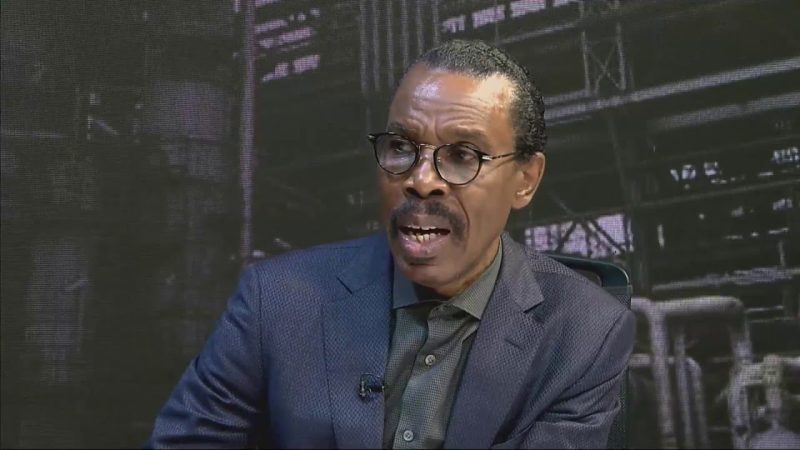

Renowned economist Mr. Bismarck Rewane supports Nigeria’s Windfall Tax on financial institutions, describing it as beneficial for equitable resource distribution.

[dropcap]R[/dropcap]enowned economist and CEO of Financial Derivatives Company, Mr. Bismarck Rewane, supports Nigeria’s Windfall Tax on financial institutions.

He views the tax as a win-win situation for both the government and citizens. The Windfall Tax aims to capture extraordinary profits, particularly from the recent naira devaluation, benefiting banks and fostering social good.

Read Also: Femi Otedola supports 70% windfall tax on banks’ forex gains, criticizes private jet expenditures

Rewane shared his insights during a recent TVC interview on ‘Business Nigeria.’ He explained the tax system’s joint venture concept, where the government and private sector share profits.

Rewane argued that by redirecting tax into public infrastructure, citizens see tangible benefits, enhancing social responsibility.

He highlighted that taxes fund government activities, stating that higher tax revenue boosts the government’s capacity for social initiatives.

According to Rewane, four principles should guide tax policy: revenue generation, ease of administration, neutrality, and equity.

The Windfall Tax aligns with the Robin Hood philosophy, where the wealthy contribute more for societal benefits. Rewane noted that this policy isn’t unique to Nigeria; other nations have implemented similar measures, such as the UK and Germany.

With Nigeria’s current tax-to-GDP ratio at 9.4%, below Ghana and South Africa, Rewane stressed the need for public trust in government spending.

He emphasised that taxpayers are more likely to comply if they see their taxes funding public goods effectively.

Rewane encouraged collaboration between the government and citizens to ensure equitable distribution of resources.

He believes effective tax policy must foster trust and transparency, highlighting the need for citizens to witness the benefits of their contributions.

“We have a moral and social responsibility to pay our taxes,” he said, underscoring the importance of perceivable government efficiency.”

Oreoluwa is an accountant and a brand writer with a flair for journalism.