CBN banking recapitalisation update: 20 banks meet capital requirements as focus shifts to productive lending and private sector development finance

The Central Bank of Nigeria has confirmed that about 20 deposit money banks have met the new capital requirements under its ongoing banking recapitalisation programme, signalling a shift toward ensuring that stronger balance sheets translate into productive lending.

Also read: NGX admits UBA shares as capital comfortably exceeds CBN rule

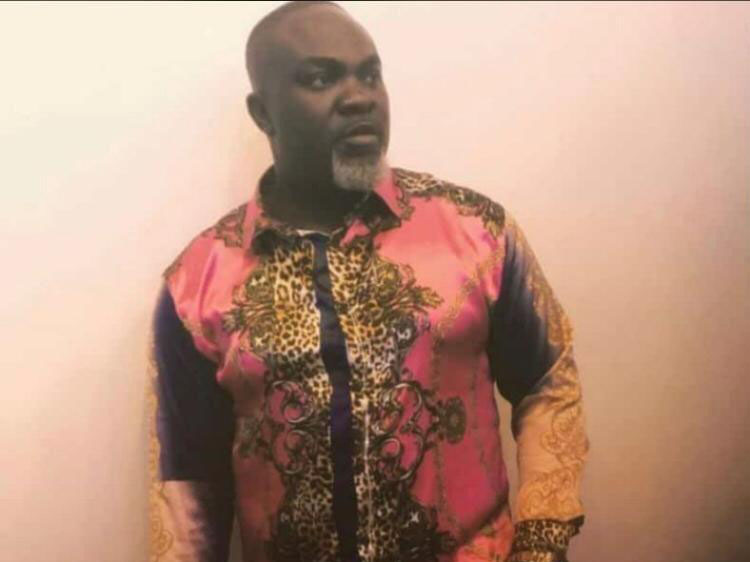

Dr Muhammad Abdullahi, Deputy Governor, Economic Policy, CBN, disclosed the progress on Thursday during a panel discussion at the launch of the 2026 Macroeconomic Outlook of the Nigerian Economic Summit Group in Lagos.

He emphasised that recapitalisation was intended to build banks capable of supporting Nigeria’s ambition of becoming a trillion-dollar economy.

“At the inception of the capitalisation programme, the major focus was ensuring that banks are strong enough to support SMEs and businesses requiring funding at reasonable rates,” Dr Abdullahi said.

“The efforts have been impressive, with about 20 banks already compliant, and more meeting requirements daily.”

He cautioned that recapitalisation alone is insufficient, stressing that the focus must now shift from larger balance sheets to well-targeted and sustainable credit.

The apex bank has strengthened its regulatory capacity through technology to monitor that increased capital translates into real sector lending, particularly to small and medium enterprises (SMEs).

Abdullahi also highlighted Nigeria’s development finance gap, estimating a funding shortfall of about N230 trillion across key sectors.

He said the CBN and Ministry of Finance are now prioritising the mobilisation of private sector capital, both domestic and international, to close the deficit efficiently.

“There’s a clear programme to correct incentives in development finance institutions to ensure funds are deployed effectively and not wasted,” he noted.

Abdullahi expressed optimism that alignment between fiscal and monetary authorities would yield visible progress in the coming months.

Meanwhile, the Minister of State for Industry, Senator John Enoh, unveiled the National Industrial Policy aimed at driving job creation, boosting manufacturing capacity, and reducing import dependence.

The policy emphasises execution, clear sequencing, institutional ownership, and alignment across trade, investment, finance, energy, skills, infrastructure, and regulation.

Structured around six pillars, the policy targets competitive industrial production, value-chain deepening, MSME-to-industry transition, trade competitiveness, AfCFTA readiness, and institutional governance.

Sectors such as agro-processing, solid minerals, petrochemicals, automotive, and pharmaceuticals have defined local value-addition thresholds.

Enoh noted that while Nigeria has over 40 million small businesses, challenges remain in linking SMEs to industrial value chains through supply development, access to long-term finance, and industry-aligned skills.

He cited the temporary ban on shea nut exports as an example of why industrial ambitions must be seriously pursued.

“The question is no longer what the policy is,” he said.

“The question is how we deliver.”

Also read: CBN T-Bills attract strong demand

An implementation framework will be unveiled alongside the policy to ensure results.