[dropcap]A[/dropcap] high-stakes legal battle has erupted between two of Nigeria’s prominent business figures, Femi Otedola, a billionaire businessman, and Jim Ovia, chairman of Zenith Bank. The dispute centers around an alleged multibillion naira fraud involving Seaforce Shipping Limited, a company owned by Otedola.

Unauthorized Transactions Uncovered

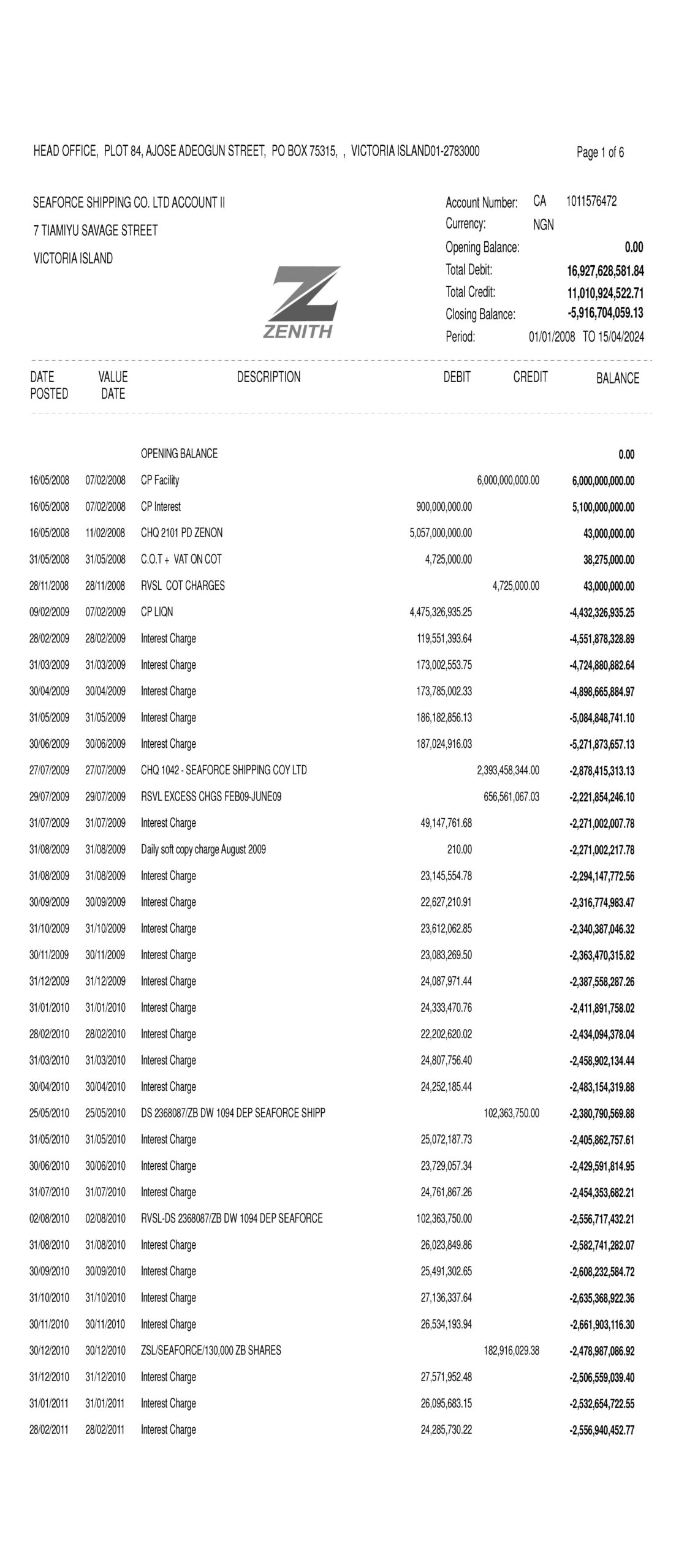

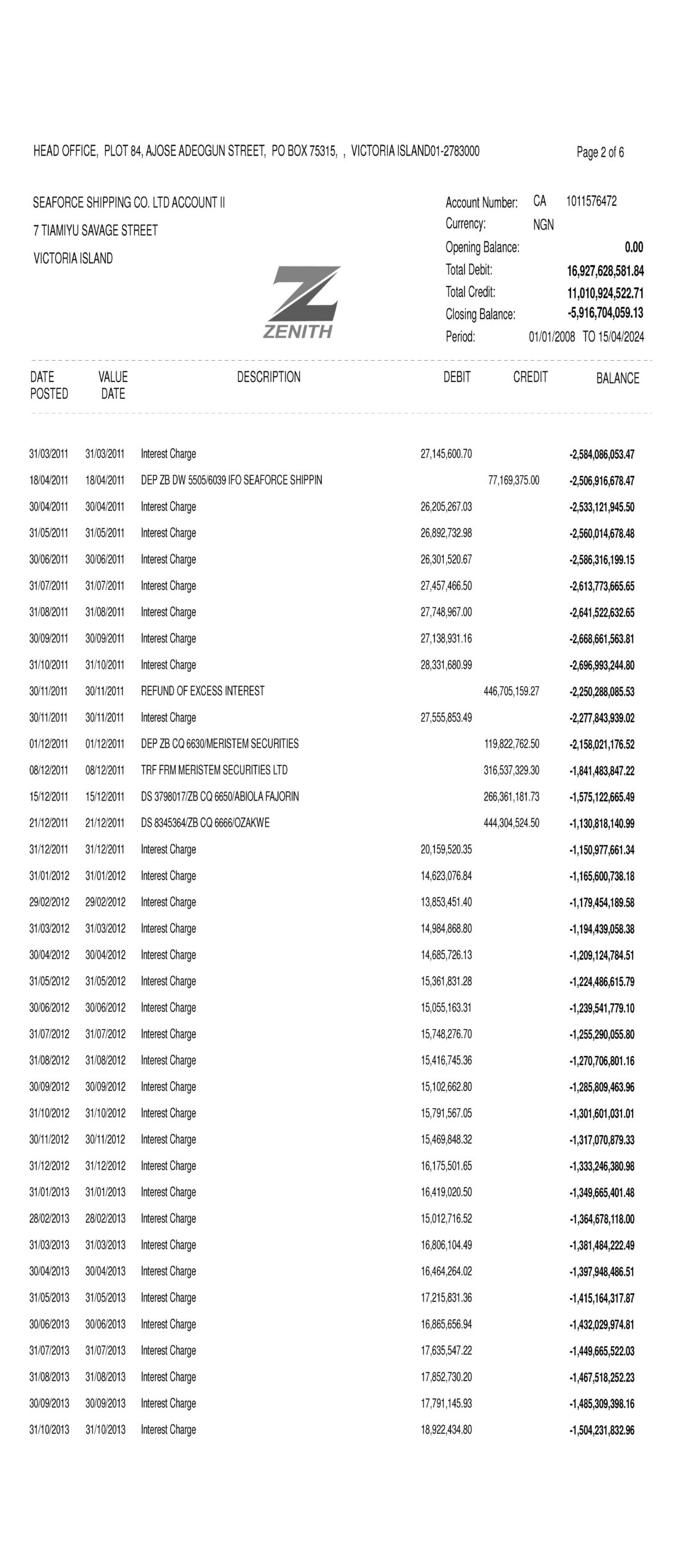

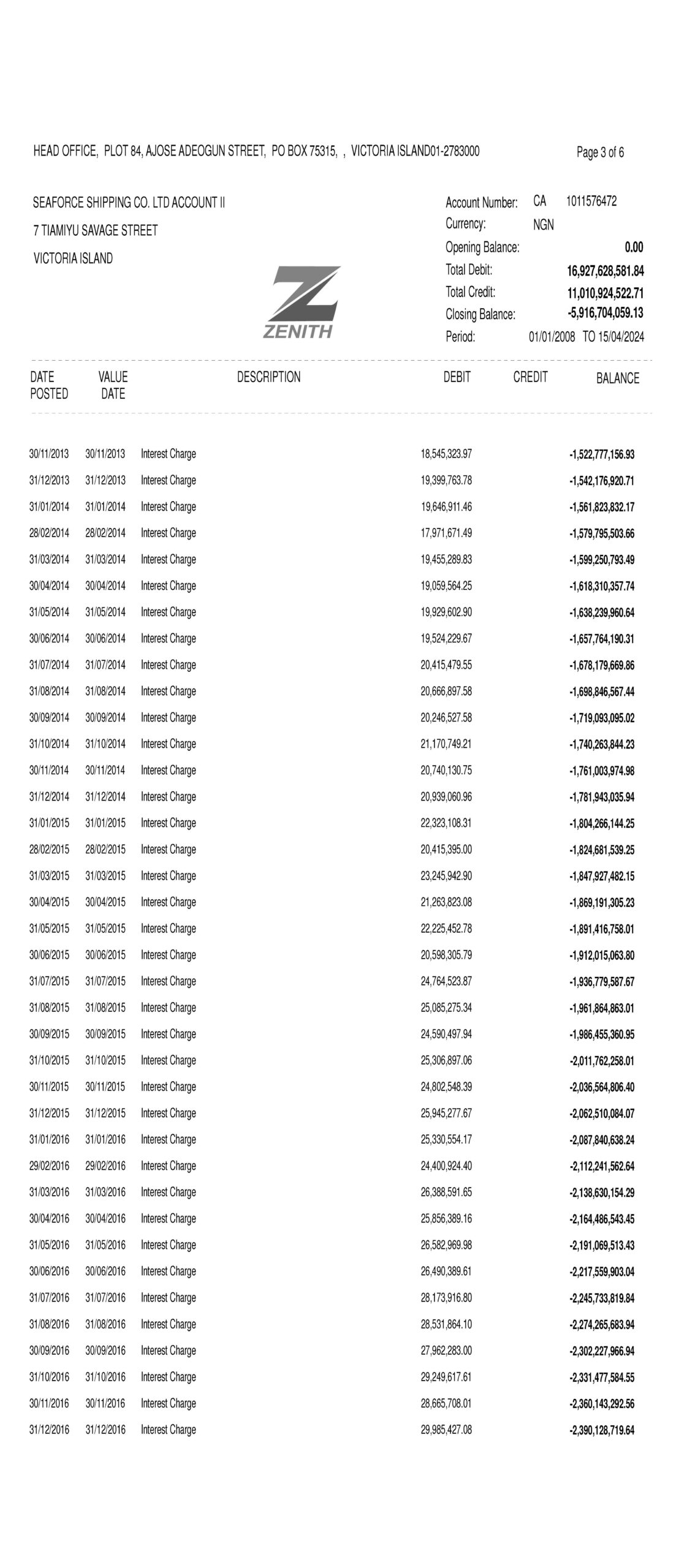

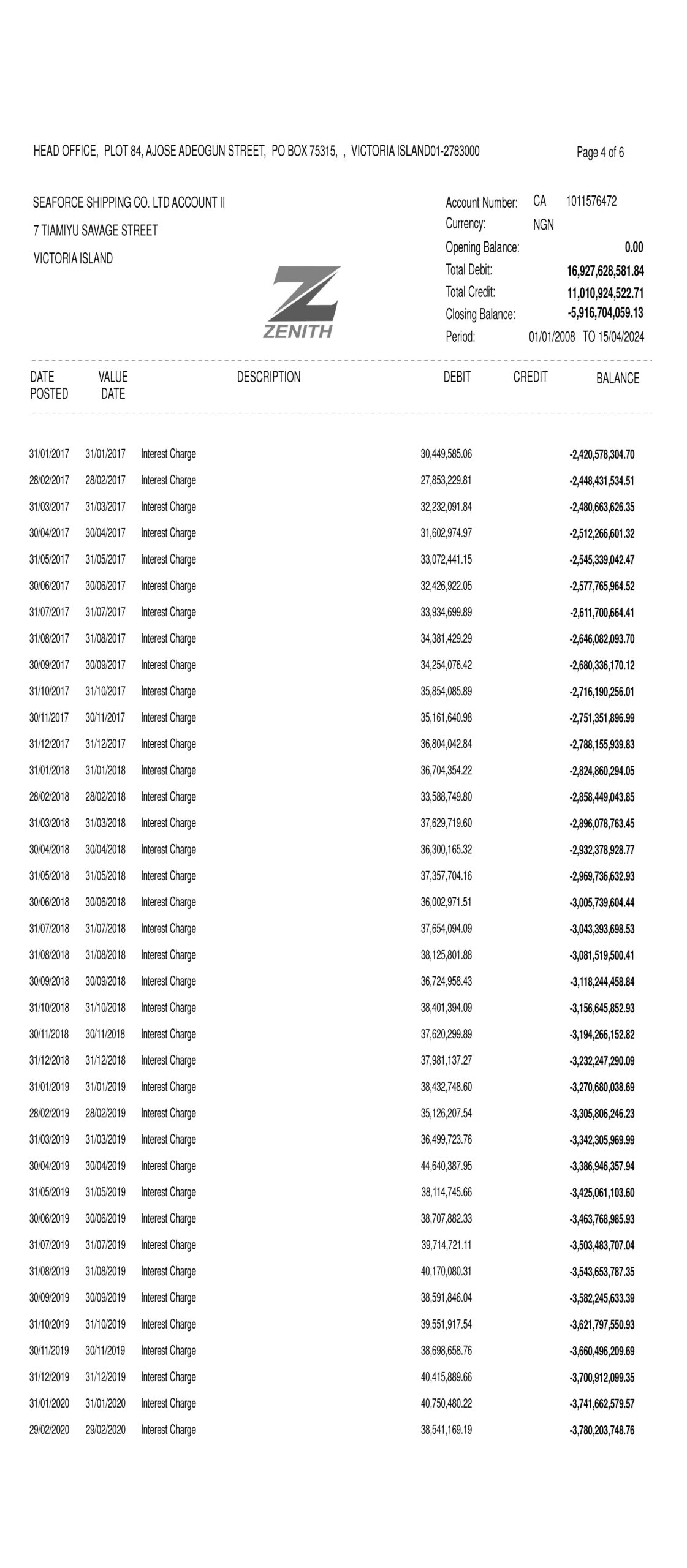

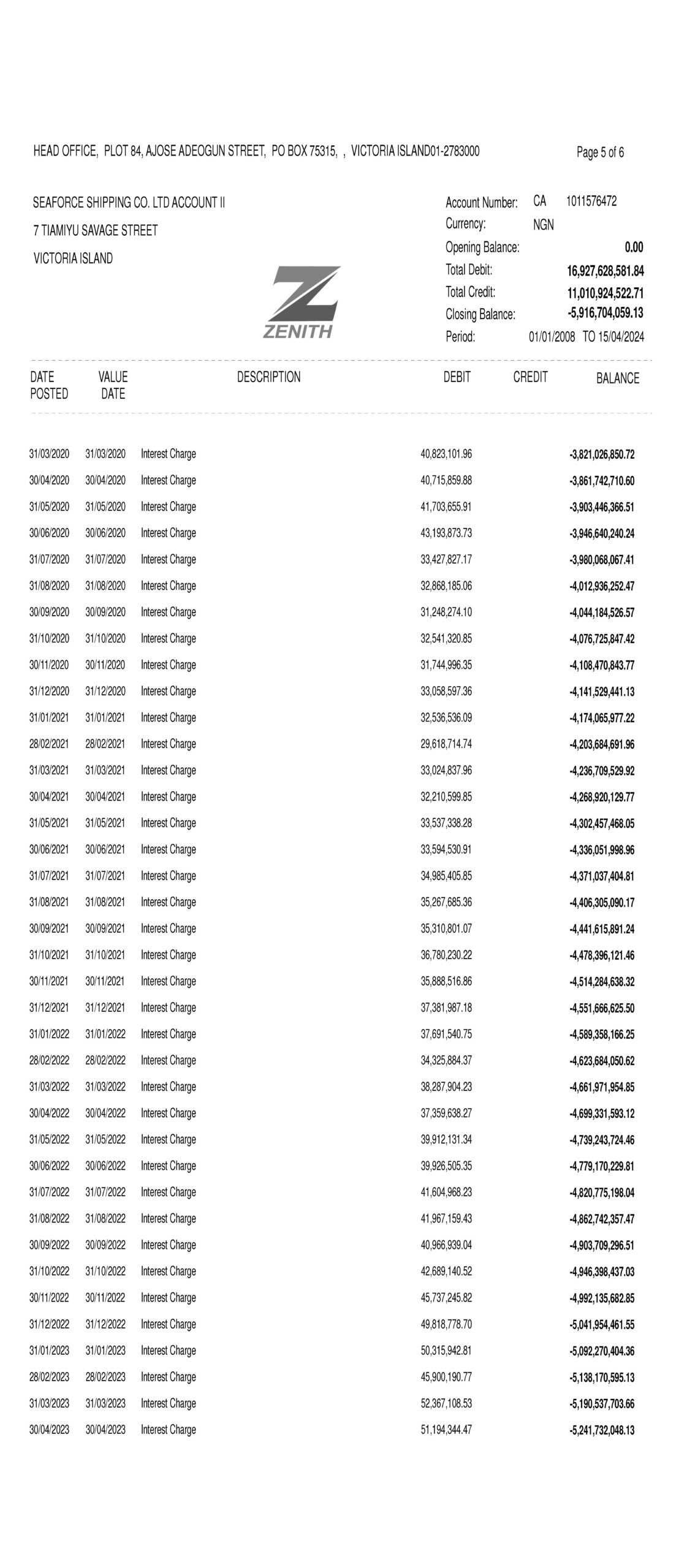

Femi Otedola has accused Zenith Bank of unlawfully using Seaforce Shipping Limited’s account for trading activities without his knowledge or consent. According to a petition Otedola filed with the Force Criminal Investigation Department (FCID) of the Nigerian police, the account, which had not been operated since 2010, continued to be used for unauthorized transactions.

Recommended read on Zenith Bank

- Another illegal N400billion transfer by fmr Zenith Bank boss to former NSA Monguno surfaces

- ‘Institutional fraud and greed’ Nigerian banks race to join CBN Too-Big-To-Fail (Part 1)

- ‘My account was cleared’ Zenith Bank customer loses all her savings to fraudsters

Otedola asserts that Seaforce Shipping Limited never applied for nor received any loans from Zenith Bank. Despite this, unauthorized trades amounting to billions of naira were conducted through the account. TheCable, which has been investigating the case, revealed that Zenith Bank could not provide documentation or offer letters to substantiate the supposed loans.

Discovery and Reaction

The suspicious activities came to light only recently, 13 years after they allegedly began, thanks to a whistleblower within Zenith Bank. Upon discovering the irregularities, Otedola confronted Zenith Bank officials, who reportedly issued an apology.

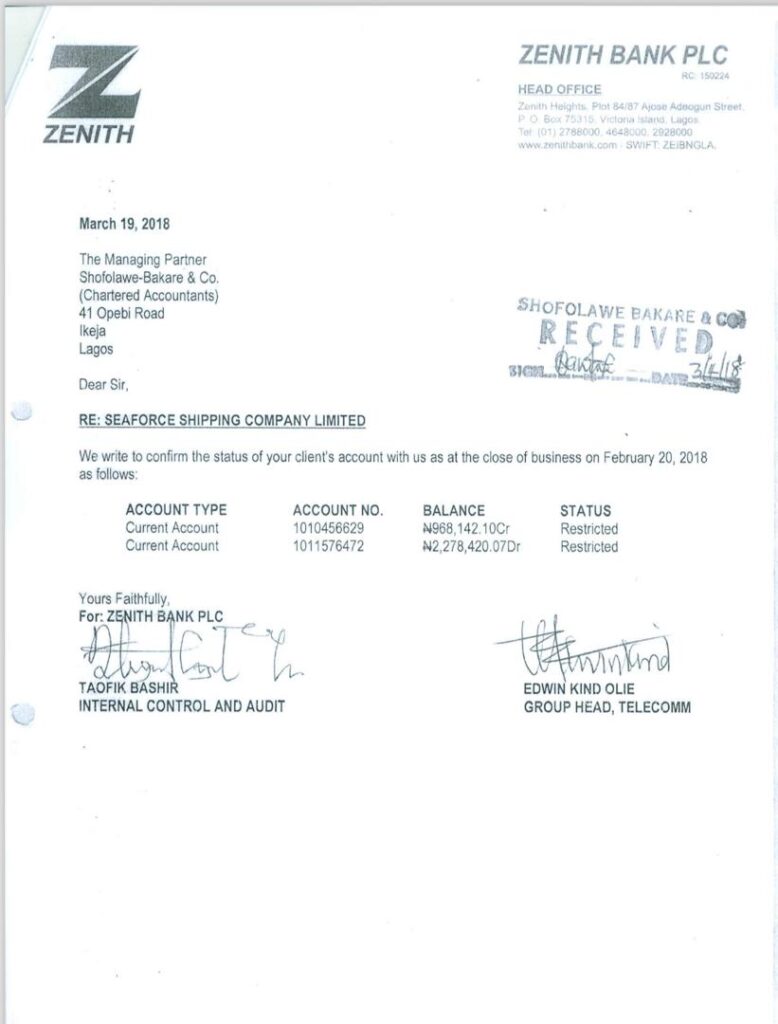

A significant piece of evidence includes a letter dated March 19, 2018, from Zenith Bank to Seaforce’s auditors, Shofolawe-Bakare & Co. The letter indicated a debt of N2,278,420 on the Seaforce account, in stark contrast to the N5 billion recorded in the bank statement seen by TheCable. On the same day, the bank statement showed a debt of N2.9 billion, compared to the N2 million stated in the letter, signed by Taofik Bashir (internal audit control) and Edwin Kind Olie (group head, telecomm).

Financial Discrepancies and Legal Moves

The transactions recorded against Seaforce’s account from 2011 to 2024 amount to over N16 billion. Otedola has questioned who made the payments that reduced the purported debt from N16.9 billion to N11 billion, as he was unaware of any such transactions. Credits noted on the account include:

- N77,169,375.00 on April 18, 2011

- N119,822,762.50 on December 1, 2011

- N316,537,329.30 on December 8, 2011

- N266,361,181.73 on December 15, 2011

- N444,304,524.50 on December 12, 2011

As of now, Seaforce Shipping Limited’s debt stands at N5,916,704,059.13, with a significant portion attributed to interest charges. The police have already questioned a senior official from Zenith Bank regarding the matter.

Court Injunction and Ongoing Investigation

In response to the situation, Otedola, along with his companies Zenon, Seaforce, Luzon Oil and Gas, and Garment Care Limited, has secured a federal high court injunction against Zenith Bank and associated entities, including Quantum Zenith Securities and Investment, Veritas Registrar, and Central Securities Clearing System. The injunction prohibits these entities from trading shares or paying dividends until the motion for an interlocutory injunction is heard.

Awaiting Responses

TheCable has reached out to both Jim Ovia and Zenith Bank for comments on the allegations and the ongoing investigation. As of now, no official statement has been released by either party.

Screenshots of Evidence

(Attached are the screenshots of the bank statements, letters, and other relevant documents that underpin the allegations.)

This developing story highlights the complexities and potential risks in Nigeria’s banking and business sectors.

Ojelabi, the publisher of Freelanews, is an award winning and professionally trained mass communicator, who writes ruthlessly about pop culture, religion, politics and entertainment.