PwC Nigeria accredited as e-invoicing system integrator to support businesses with digital tax compliance under the MBS platform

PwC Nigeria has been officially accredited as a system integrator for Nigeria’s mandatory e-invoicing system under the Monitoring, Billing and Settlement (MBS) platform.

Also read: Viral video shows heated domestic altercation between PwC lawyer, wife (WATCH)

The move forms part of the country’s broader efforts to digitise tax administration, enhance transparency, and improve the accuracy of transaction-level tax reporting.

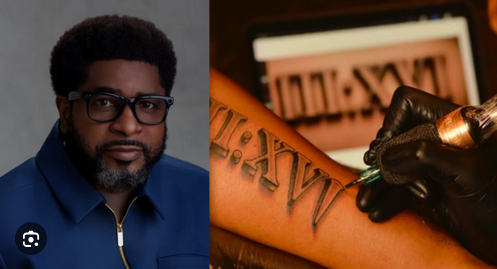

Chijioke Uwaegbute, Partner and Tax & Regulatory Services Leader at PwC Nigeria, said the e-invoicing mandate reflects global trends towards real-time oversight and greater transparency in tax reporting.

He noted that PwC would assist businesses in managing complexity, protecting value, and building trust across the tax ecosystem during the transition.

“E-invoicing embeds tax compliance directly into everyday business activity. As transaction data moves into real-time digital systems, organisations must be able to rely on that data for tax reporting, audits, and regulatory review,” Uwaegbute said.

He emphasised that treating e-invoicing solely as a technology exercise could expose organisations to data inconsistencies and control gaps, highlighting the importance of integrating tax expertise into system design and governance from the outset.

The MBS framework requires organisations to transmit invoice data to the National Revenue Service (NRS) platform in real time, replacing traditional paper-based invoicing with a digital validation system.

Accredited system integrators like PwC are tasked with ensuring secure, reliable connectivity between taxpayers’ systems and the Federal Inland Revenue Service (FIRS) platform.

Tim Siloma, Partner and Tax Technology Leader at PwC Nigeria, added that the firm would work with organisations to review invoicing and reporting processes, implement system integrations, and support ongoing compliance as e-invoicing requirements evolve.

Also read: Nigeria tax reforms trigger major compliance shift for businesses

“Technology can automate invoicing. However, interpreting tax requirements and managing risk require tax expertise. Our tax technology capability brings advisory expertise into execution, enabling organisations to manage complexity, maintain control, and rely on e-invoicing as compliance becomes embedded into operations,” Siloma said.