Moniepoint customers in Nigeria report frozen accounts, missing funds, and security concerns, urging the CBN to investigate the fintech bank

[dropcap]M[/dropcap]oniepoint, a leading Nigerian fintech bank, is facing widespread customer dissatisfaction over unresolved account freezes, missing funds, and security breaches.

Also read: OPay introduces N50 transfer fee for transactions over N10,000

Several affected customers have taken to social media and news outlets to voice their grievances, calling on the Federal Government and the Central Bank of Nigeria (CBN) to intervene.

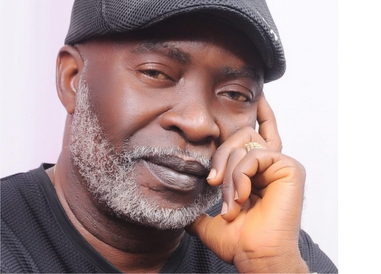

Suleiman Abubakar Audu, one of the affected customers, disclosed that his Moniepoint account, holding ₦522,000, has been inaccessible for over ten weeks without any resolution.

Despite providing all required documentation and making multiple inquiries, he remains locked out of his funds.

“Moniepoint blocked my account for over 10 weeks. I have provided all the necessary information, but they still haven’t released my account,” Audu stated.

Similarly, Busayo Busayo expressed frustration over ₦50,000 deducted from her account since October 2024, with no refund or meaningful response from Moniepoint.

“Moniepoint na ole (are thieves). Since October, my ₦50k is still with them with no refunds. Every time I chat with them, it’s a different story,” she lamented.

Beyond frozen accounts, some customers raised security concerns regarding Moniepoint’s banking system.

A user identified as Adeboye alleged that an unknown person had used his phone number to open a Moniepoint account without his consent, even upgrading it to a merchant-level account.

“Someone is using my number and account for Moniepoint. OTP was sent to me twice when I didn’t request it. Next thing I saw was a message saying my password was reset,” he revealed.

Other customers, like Kelvin Doris, a student, have struggled with delayed transactions, impacting their daily lives.

“I did a refund on Monday from Moniepoint to UBA, but I have not seen the money,” Doris stated, adding that he urgently needed the funds for school fees.

Amid these complaints, pressure is mounting on the CBN and the Federal Government to investigate Moniepoint’s operations and address the challenges faced by its users.

Also read: Nigerians worried as Central Bank disconnects Opay, Palmpay, others

These concerns follow recent revelations by the Nigerian Police Force, which uncovered a scam involving fraudsters who stole over ₦400 million using Moniepoint accounts.