Wema Bank achieves strong capital boost after ₦150bn Rights Issue, surpassing ₦200bn CBN requirement ahead of 2026 deadline

The recapitalization move, which opened on April 14 and closed on May 21, 2025, was part of the bank’s response to the CBN’s directive on raising minimum capital for lenders.

Also read: Wema Bank’s H1 2025 results show stunning 231% profit surge amid market challenges

With this milestone, Wema Bank has now met and exceeded the ₦200 billion capital requirement for commercial banks with national authorization.

In addition to the Rights Issue, the bank recently concluded a ₦50 billion Private Placement that is awaiting regulatory review.

This extra capital further strengthens Wema Bank’s financial buffer, enhances its ability to withstand shocks, and positions it for sustainable growth.

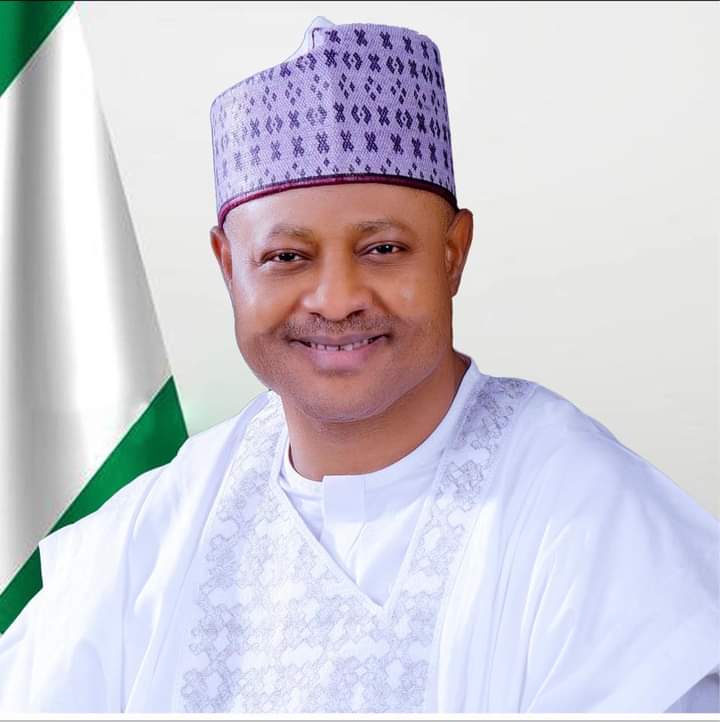

Speaking on the achievement, Wema Bank’s Managing Director and Chief Executive Officer, Moruf Oseni, described the success as proof of the mutual trust between the bank and its shareholders.

He noted that surpassing the recapitalization target ahead of the 2026 deadline demonstrates the institution’s resilience and long-term vision.

The conclusion of these capital-raising initiatives not only reinforces Wema Bank’s prudential standing but also highlights stakeholders’ confidence in its governance, financial performance, and strategic direction.

Also read: Wema Bank achieves elevated credit ratings from Fitch

With a stronger capital base, the bank says it is well prepared to support customers, contribute to financial system stability, and deliver lasting value to shareholders.