Otedola First HoldCo loan cleanup triggers profit drop as chairman says N748bn charge will restore trust and strengthen long-term stability

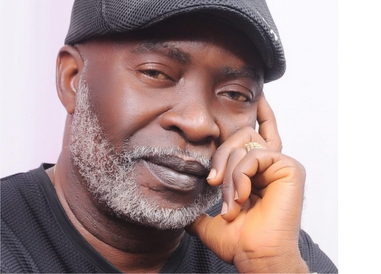

Femi Otedola, Group Chairman of First Bank Holdings Plc, defended the company’s decision to take a one-time charge of N748 billion to clear legacy bad loans, stating that the move was necessary for long-term financial stability despite a sharp decline in reported profits.

Also read: Energy tycoon, Wale Tinubu hails Otedola, Elumelu on mega deals

Femi Otedola disclosed the rationale in a post shared on his X account on Saturday, explaining that the heavy provisioning caused the holding company’s profit to fall by 92 per cent.

Femi Otedola wrote, “At First HoldCo we decided to clean house properly. We took a huge one-time hit of N748bn to admit old bad loans instead of pretending they do not exist.

That is why profit looks like it crashed by 92 per cent. Painful headline, but it is a serious long-term move.”

Femi Otedola said the decision aligned with the Central Bank of Nigeria’s directive for banks to address non-performing loans transparently rather than defer the problems into future reporting cycles.

Femi Otedola added, “Why do this now? Because the CBN is pushing banks to stop kicking problems down the road. So First HoldCo basically closed the chapter on messy loans from past years which sends a clear message that borrowing has consequences and it helps rebuild trust.”

Despite the write-off, Femi Otedola emphasised that the bank’s core operations remained strong, citing substantial revenue performance that allowed the institution to absorb the impact of the cleanup.

Femi Otedola stated that the bank recorded N2.96 trillion in interest income and N1.91 trillion in net interest income, which provided the financial strength to undertake the exercise without undermining operational stability.

Femi Otedola said, “The key point is this: our business itself is still strong. It made N2.96tn in interest income and N1.91tn in net interest income, which gave it the strength to take the cleanup and still stay standing.”

Femi Otedola expressed confidence that the action would position First Bank favourably ahead of the anticipated recapitalisation phase and support future growth.

Also read: Femi Otedola hails Tinubu’s bold 15% fuel tariff policy

Femi Otedola concluded, “Now at First Bank and beyond we go into 2026 lighter, cleaner and better prepared for the recapitalisation era and serious growth. Bad loans cleared plus strong income engine plus long-term thinking equals real value creation.”