Sterling Bank staff and accomplices face court over a N1.25 billion fraud involving hacking and money laundering. Trial set for March 2025

[dropcap]S[/dropcap]terling Bank Limited and its holding company, Sterling Financial Holdings, are embroiled in a legal battle over a staggering N1.257 billion stolen by some of its staff members in collaboration with external fraudsters.

Also read: Access Bank denies missing ₦500 million from deceased customer’s account

The incident involved a sophisticated hacking of the bank’s platform, leading to the theft of depositors’ funds.

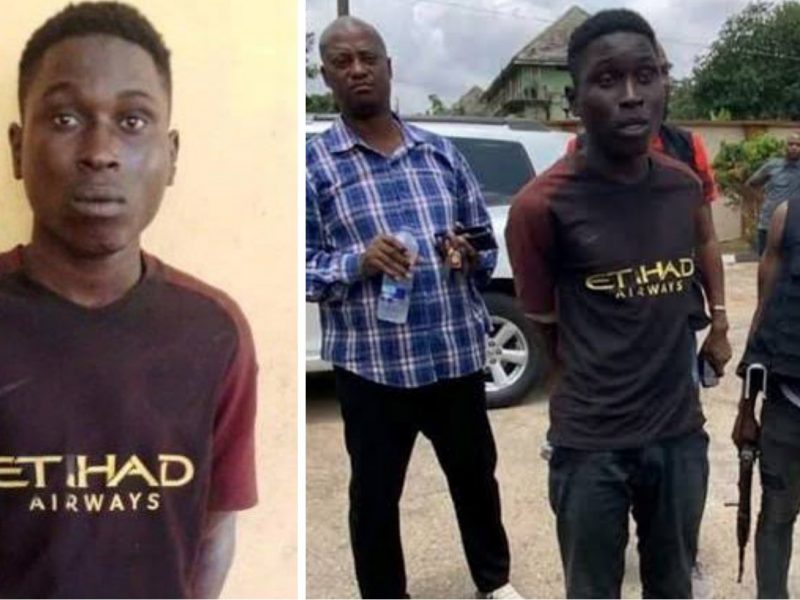

The suspects—Victor Nwabueze (50), Favour Odey (22), Adekunle Daniel (34), Akachukwu Alagbogu, and Yetunde Oguntade (28)—were arraigned before Justice Ambrose Lewis-Allagoa at the Federal High Court in Lagos on Thursday, 18 January 2025.

They face a three-count charge of conspiracy, hacking, and money laundering under the Cybercrimes Act and the Money Laundering Prohibition Act.

According to the prosecutor, Barrister Justine Enang, the suspects, in collusion with Sterling Bank employees, used compromised data, including IP addresses and mobile equipment identities, to transfer the stolen funds into fraudulent accounts on November 3 and 4, 2024.

Enang argued that the defendants violated sections of the Cyber Crimes (Prohibition, Prevention, Etc.) Act, 2015, and the Money Laundering (Prevention and Prohibition) Act, 2022, by committing internet fraud and laundering the stolen money.

The charges against the defendants include conspiracy to commit internet fraud, causing financial loss to Sterling Bank, and converting stolen funds to their personal use.

The prosecution contends that the suspects used advanced hacking methods to bypass the bank’s security systems and illicitly transfer funds to fraudulent accounts.

Despite the serious charges, the suspects pleaded not guilty to all counts. The prosecution opposed granting bail, citing the risk of the defendants fleeing the jurisdiction.

However, Justice Lewis-Allagoa granted each defendant bail at N50 million, with the condition that they provide a surety who owns landed property within the court’s jurisdiction.

Also read: Access Bank denies missing ₦500 million from deceased customer’s account

Pending the fulfillment of bail conditions, the accused were remanded in custody. The case has been adjourned to 13 March 2025 for trial.