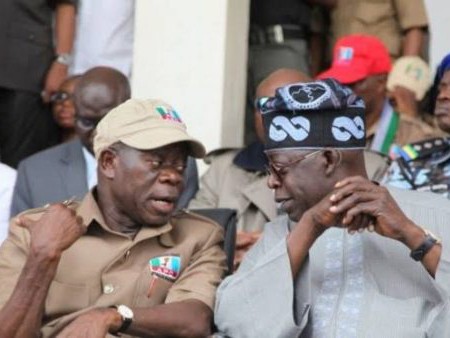

Senator Adams Oshiomhole says Tinubu tax policy is progressive, shifting the burden to the wealthy while protecting low-income earners

Senator Adams Oshiomhole has defended the Tinubu tax policy, insisting that it reflects the principles of a progressive government by easing the burden on low-income earners while placing greater responsibility on the wealthy.

Also read: LIRS reminds employers of January 31 tax return deadline

The Edo North lawmaker made the remarks on Wednesday while speaking on Channels Television’s Politics Today, explaining that he supported the tax reforms before they were signed into law because of their equity-driven framework.

Oshiomhole said the Tinubu tax policy was designed to align taxation with income levels, describing it as socially responsive and fair.

According to him, those who earn more are now required to contribute more, while those with lower incomes benefit from exemptions.

“The facts on the ground show that President Tinubu’s tax policy is consistent with the values of a progressive government,” he said.

“This is a progressive tax policy that places a higher burden on those who earn more while offering tax exemptions to those who earn less.”

The former Edo State governor stressed that taxation remains central to governance, arguing that governments do not generate revenue independently of citizens.

He said public revenue is derived from taxes paid by individuals and corporate bodies, which are then used to fund governance.

Oshiomhole further noted that the Tinubu tax policy protects workers, pointing out that most Nigerian salary earners fall below the higher tax thresholds.

He said it was unrealistic to suggest that average workers, including members of the Nigeria Labour Congress, earn incomes that would expose them to heavier taxation.

On Value Added Tax, the senator dismissed widespread concerns, saying VAT mainly applies to luxury and non-essential items rather than basic goods.

He described resistance to VAT payments within Nigeria as inconsistent, noting that Nigerians willingly pay similar taxes when shopping abroad.

Despite ongoing public debate, President Bola Tinubu reiterated in December 2025 that the new tax laws would take effect from January 1, 2026.

Also read: LIRS sets January tax deadline

The President said the reforms were aimed at a structural reset of the tax system, strengthening the social contract and protecting citizens’ dignity rather than imposing arbitrary tax increases.